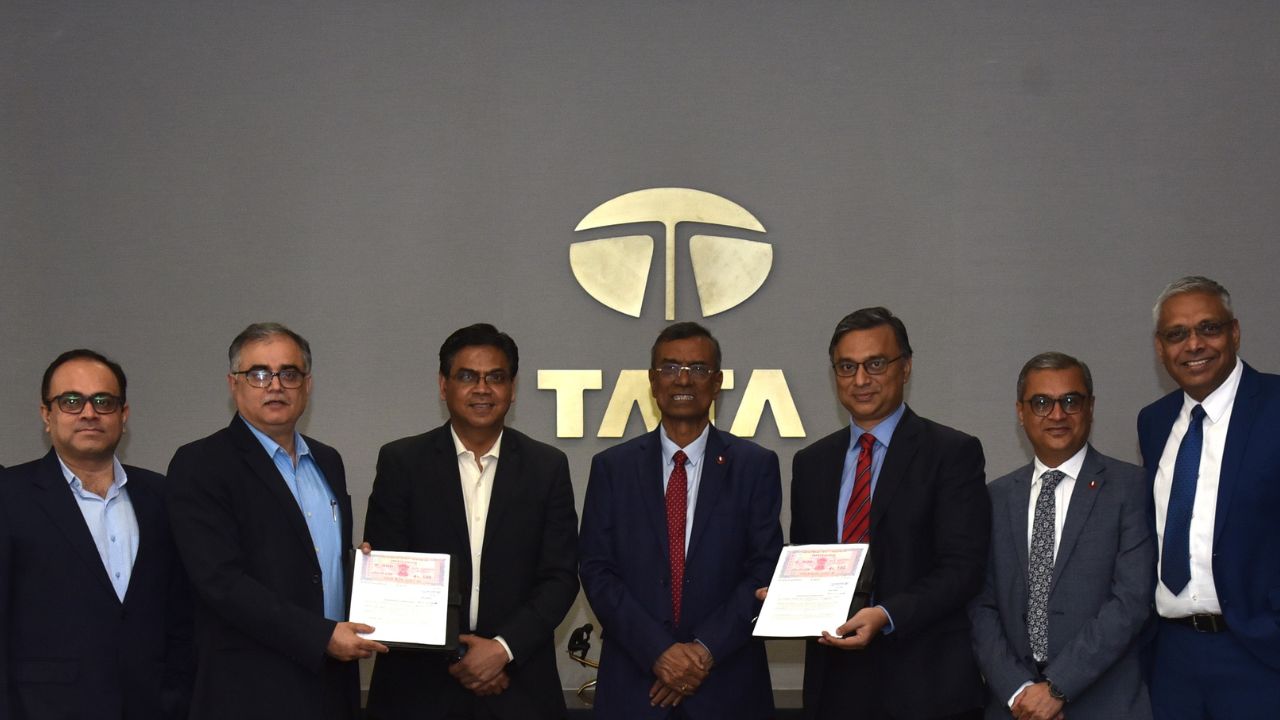

Tata Motors and Bandhan Bank Sign MoU for Commercial Vehicle Financing Solutions

#TataMotors #BandhanBank #CommercialVehicles“This partnership reflects our commitment to providing accessible and efficient financial solutions, empowering our customers to achieve their business goals with ease. Together, we look forward to driving greater convenience and support for our valued commercial vehicle customers.” - Rajesh Kaul, Vice President & Business Head – Trucks, Tata Motors

February 2024 : Tata Motors, India’s largest commercial vehicle manufacturer, has signed a Memorandum of Understanding (MoU) with Bandhan Bank, one of India’s fastest-growing private sector banks, to offer convenient financing solutions to its commercial vehicle customers. Under this collaboration, Bandhan Bank will offer financing across the entire commercial vehicle portfolio and customers will benefit from the bank’s wide network and specially curated easy repayment plans.

Commenting on this partnership, Rajesh Kaul, Vice President & Business Head – Trucks, Tata Motors, said, “We are delighted to announce our partnership with Bandhan Bank through this MoU, which represents a major milestone in our commitment to providing seamless financing solutions to our customers. This partnership reflects our commitment to providing accessible and efficient financial solutions, empowering our customers to achieve their business goals with ease. Together, we look forward to driving greater convenience and support for our valued commercial vehicle customers.”

Speaking on this announcement, Santosh Nair, Head, Consumer Lending & Mortgages, Bandhan Bank, said, “Bandhan Bank is pleased to partner with Tata Motors to offer seamless vehicle financing solutions. This association reflects our dedication to serving the diverse financial needs of commercial vehicle customers. We are confident that this collaboration will enable us to extend our reach and provide tailored financing options to support the growth of businesses in the commercial vehicle segment.”

NEWSLETTER

TRENDING ON PRO MFG

MORE FROM THE SECTION